Navigating Profitability: The Essentials of Effective Financial Management

In the competitive landscape of modern business, effective financial management stands as a cornerstone of sustainable profitability. Whether you’re a multinational corporation or a small startup, mastering the art of financial management is essential for navigating uncertainties, seizing opportunities, and achieving long-term success.

At its core, effective financial management revolves around three key principles: planning, monitoring, and optimizing.

- Planning:

- Strategic Budgeting: Establishing a comprehensive budget that aligns with your business goals and objectives is the first step towards effective financial management. By forecasting revenues, expenses, and cash flows, you can anticipate future financial needs and allocate resources strategically.

- Investment Strategy: Developing a clear investment strategy that balances risk and return is essential for maximizing profitability. Whether it’s investing in technology upgrades, expanding market reach, or diversifying product offerings, thoughtful capital allocation is key to driving growth and enhancing shareholder value.

- Monitoring:

- Financial Reporting: Regularly monitoring and analyzing financial performance through accurate and timely financial reporting is critical for identifying trends, evaluating performance, and making informed decisions. Key performance indicators (KPIs) such as gross profit margin, operating cash flow, and return on investment provide valuable insights into the health of your business.

- Variance Analysis: Conducting variance analysis to compare actual financial results against budgeted expectations allows you to pinpoint areas of strength and weakness. By identifying deviations from the plan early on, you can take corrective action to mitigate risks and optimize performance.

- Optimizing:

- Cost Management: Implementing cost management strategies to control expenses and improve operational efficiency is essential for enhancing profitability. Whether it’s renegotiating vendor contracts, streamlining processes, or leveraging technology to automate tasks, every cost-saving initiative contributes to the bottom line.

- Revenue Enhancement: Driving revenue growth through strategic pricing, product innovation, and customer acquisition initiatives is equally important for maximizing profitability. By identifying untapped market opportunities, understanding customer needs, and delivering exceptional value, you can increase sales and market share, thereby boosting profitability.

In conclusion, effective financial management is the cornerstone of profitability in any business. By adhering to the principles of planning, monitoring, and optimizing, you can navigate the complexities of the financial landscape with confidence, driving sustainable growth and success in the dynamic world of business.

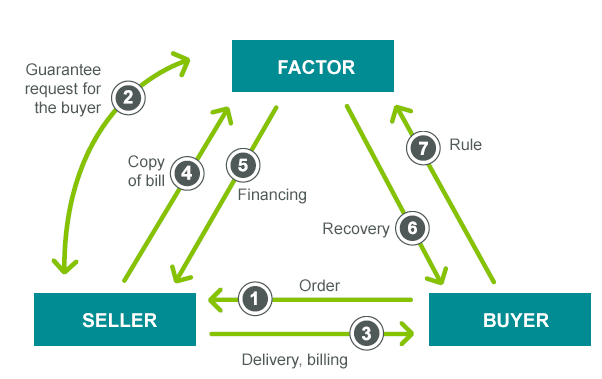

Export factoring stands as a strategic financial tool designed to provide exporters with immediate liquidity by converting their accounts receivable…

In the interconnected web of international commerce, export financing stands as a critical enabler, facilitating the seamless flow of goods…