Unlocking Cash Flow: Understanding the Basics of Export Factoring

Export factoring stands as a strategic financial tool designed to provide exporters with immediate liquidity by converting their accounts receivable into cash. In essence, it involves the sale of export invoices to a factoring company, known as a factor, at a discounted rate in exchange for upfront funding.

At its core, export factoring offers exporters a straightforward solution to address cash flow challenges arising from lengthy payment cycles and credit terms in international trade. Rather than waiting for customers to pay invoices on extended credit terms, exporters can leverage export factoring to access a significant portion of the invoice value upfront, typically within 24 to 48 hours of invoice verification.

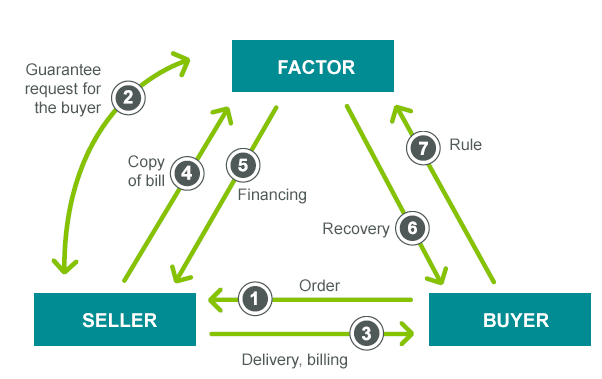

The process of export factoring typically involves several key steps:

- Agreement: The exporter enters into a factoring agreement with a reputable factoring company. This agreement outlines the terms and conditions of the factoring arrangement, including fees, advance rates, and recourse provisions.

- Invoice Submission: Upon shipment of goods or provision of services to the overseas buyer, the exporter submits the corresponding invoices to the factor for verification.

- Verification and Advance: The factor verifies the authenticity of the invoices and the creditworthiness of the buyer. Once verified, the factor advances a predetermined percentage of the invoice value to the exporter, typically ranging from 70% to 90%.

- Collection and Rebate: The factor assumes responsibility for collecting payment from the buyer within the agreed credit terms. Once the buyer settles the invoice, the factor deducts its fees and rebate the remaining balance to the exporter, minus any applicable financing charges.

Export factoring offers several advantages for exporters:

- Improved Cash Flow: Exporters gain immediate access to cash, enabling them to fund ongoing operations, fulfill new orders, and seize growth opportunities without waiting for customer payments.

- Risk Mitigation: Export factoring provides protection against non-payment and insolvency risks associated with overseas buyers. Factors conduct thorough credit assessments of buyers, reducing the likelihood of bad debts.

- Administrative Support: Factoring companies often offer additional services such as credit management, collection, and receivables administration, relieving exporters of the burden of these tasks and allowing them to focus on core business activities.

- Flexibility: Export factoring is a flexible financing solution that can be tailored to meet the specific needs of exporters, regardless of their size or industry.

In conclusion, export factoring serves as a valuable financial tool for exporters seeking to optimize cash flow, mitigate risks, and unlock growth opportunities in the global marketplace. By converting accounts receivable into immediate cash, export factoring empowers exporters to navigate the complexities of international trade with confidence and agility.

In the competitive landscape of modern business, effective financial management stands as a cornerstone of sustainable profitability. Whether you’re a…

In the interconnected web of international commerce, export financing stands as a critical enabler, facilitating the seamless flow of goods…